Introduction

Martus’ Cash Flow Forecasting module provides a way to predict the impact of a budget on cash flow and on your balance sheet. The Cash Flow Forecasting module provides for a Projected Balance Sheet, along with a Cash Flow Forecast that is derived from and ties to that balance sheet.

Every budgeted item has an impact on a balance sheet account. In the most straightforward examples: budgeted sales increase Accounts Receivable, while budgeted expenses increase Accounts Payable. Martus makes it easy to define the balance sheet impact of each budget line. Martus also provides a method to define the cash flow impact of balance-sheet-only items such as prepaid expenses, loan payments, deferred revenue, and VAT or sales tax. The Cash Flow Forecasting module also includes extensive reporting on the balance sheet impact of each budget line so that you can fully trace and confirm the impact of what you’ve budgeted.

Cash Flow Forecasting is part of Martus’ Premium subscription level. The Balance Sheet Impact is calculated on the basis of a budget. Once you’ve completed a budget, you build the balance sheet impact, then use that to produce a Projected Balance Sheet and a Statement of Projected Cash Flows.

Configuring Martus for Cash Flow Forecasting

Defining Amortization Schedules

Amortization Schedules define the timing of how a budgeted item affects your cash flow. Martus is preconfigured with a set of amortization schedules. Assign a default offset account and amortization schedule to each income and expense account. These defaults will be used for all budget items. However, you can set an override on any budget or SPW line. Note: There should always be one amortization schedule with a “0” amortization, which is required whenever a budgeted line affects a cash account.

Setting the Default Offset Accounts and Amortization Schedules for P&L Accounts

Assign a default offset account and amortization schedule to each income and expense account. These defaults will be used for all budget items. However, you can set an override on any budget or SPW line.

Balance Sheet Categories

Account categories control the organization of the Projected Balance Sheet. Martus is pre-configured with a suggested set of categories for balance sheet accounts. You can add or remove categories from this set, but remember, these control the sequence of information, subtotals, and totals on the Projected Balance Sheet! Assign the appropriate category to each balance sheet account. Balance sheet categories default to expanded on the Projected Balance Sheet.

Cash Flow Categories

Cash flow categories control the organization of the Statement of Projected Cash Flows. Martus is preconfigured with four Cash Flow categories: Operating Activities, Investing Activities, Financing Activities, and Cash on Hand. (You can change the names of these categories if you wish.) Assign a cash flow category to each balance sheet account. These categories are used to group and total balance sheet accounts on the Statement of Projected Cash Flows.

System Options

These are set at the time of implementation:

- Reporting Level. A system option can be used to identify the balancing dimension (also sometimes called the reporting dimension) for the Projected Balance Sheet and Statement of Projected Cash Flows.

- For multi-entity Sage Intacct integrations, this will typically be Location. All Balance Sheet and Cash Flow reporting is done at the highest parent for this dimension (i.e., reporting is thus at the entity level). Items that affect the balance sheet but do not affect the budget will require the assignment of a location; valid values are the highest-level values for this dimension.

- For Sage Intacct integrations with a single entity, or other integrations such as QuickBooks where there is only one entity within the accounting system, this system option is not used since there is only one reporting level within Martus’ Cash Flow Forecasting.

- Balance Sheet Cash Account Category. This system option identifies the Martus account category for your cash accounts. The Balance Sheet will highlight your "Impact on Cash" each month, which is the total monthly change in value for all accounts in this category.

Starting Balance Sheet Numbers

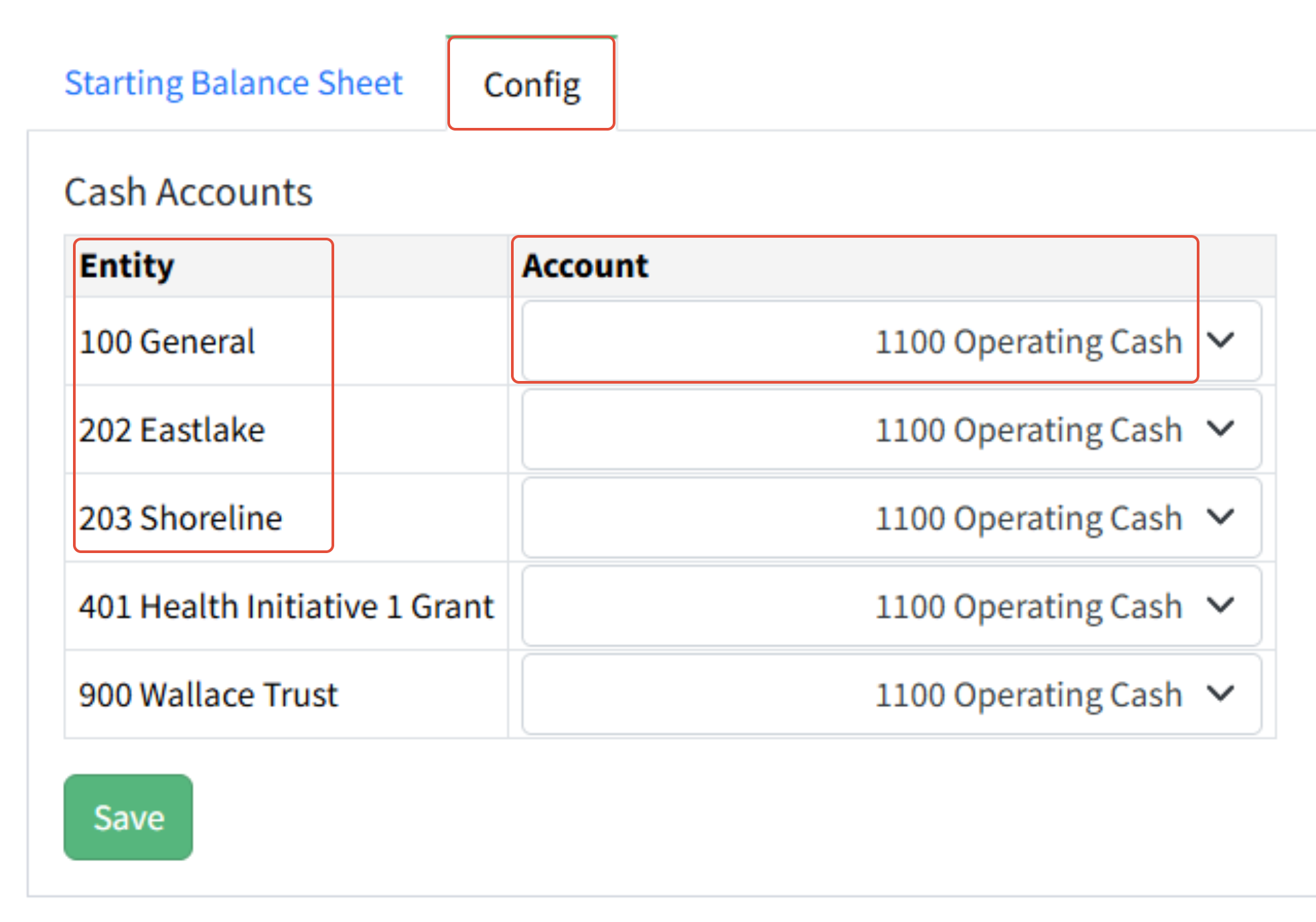

On the Starting Balance Sheet tab, enter balances for each balance sheet account (and balancing dimension). This information can be imported from an Excel spreadsheet, if you wish. Also, specify the cash account for each balancing dimension on the Config tab. This account number is used to absorb the Impact on Cash shown on the Projected Balance Sheet.

Martus supports multiple starting balance what-if scenarios and the ability to load actual balances into them.

- A dropdown allows for selecting starting balance scenarios on the Projected Balance Sheet and Statement of Projected Cash Flow, with calculations updated to incorporate scenario selection and amortization.

- Martus supports loading actual balances into scenarios via a modal, with date restrictions based on fiscal year, and allows locking balances to prevent updates from actuals.

- Scenario management features include copying scenarios across years, loading actuals, and handling scenario permissions for different user roles, with scenario creation and editing restricted to owners or Admins.

- The import/export process includes scenario data, validates scenario ownership, and respects lock statuses, ensuring data integrity during bulk operations.

Specify the cash account for each balancing dimension on the Config tab.

Add entries to the Starting Balance Sheet table. Lock starting values to prevent changes.

Alternatively, click Load Actuals to use actuals as the starting amount for each row. Select the last month of the prior fiscal year. The ending balance of that month will be used for the starting amount.

Keep in mind that loading actual balances will not load the Change in Net Assets amount. You will need to manually add it to your retained earnings account after loading.

Create a scenario for the starting balance sheet using Create Scenario. Name the scenario, and then populate the rows in the table by adding manual entries, loading actuals, or uploading a file. You can also copy an existing scenario.

Review User Permissions

Admin users can always set cash flow overrides on any budget line or within SPWs. The user permission “Cash Flow Overrides” controls whether non-admin users can set cash flow overrides. Non-admins are never permitted to see lines on global SPWs that apply only to balance sheet accounts.

Budgeting for Balance Sheet Accounts – Making the Transition to Using Martus’ Cash Flow Forecasting

Previously, Martus recommended that you budget for balance sheet accounts by changing the account type to Income or Expense. With Cash Flow Forecasting, this is no longer necessary to obtain a clear picture of the balance sheet and cash flow impact of activity such as mortgage payments and capital expenditures. Instead, the best practice is to allow those accounts to be synced as balance sheet accounts in Martus, then create Global SPWs to account for such items as mortgage payments, depreciation, and purchase of fixed assets.

You can continue to treat those kinds of items as income or expense accounts and budget directly for them if wish; if you do that, those accounts will affect the balance sheet just as any other income or expense account. If you continue to budget for them as you have done in the past, they will be reflected on the Projected Balance Sheet and Statement of Projected Cash Flows with other P&L accounts. If you are not sure how you want to handle these accounts in the future, you can leave them as P&L accounts and update them later.

Follow these steps to update any balance sheet accounts that were previously set as Income or Expense accounts for which you will no longer budget directly:

- Make sure that nothing is currently budgeted to these accounts.

- In Setup > Accounts, select these accounts and unlock the type.

- In Dashboard > Updater, run an account sync.

- Add items to Global SPWs for these items, using the appropriate cash flow templates to ensure the correct impact on the projected balance sheet and cash flow.

The Balance Sheet Impact of Items on the Budget Worksheet

Every item budgeted on a worksheet has a balance sheet impact. The balance sheet impact of a budget item can be determined by the default Amortization Schedule and Offset Account for the GL account used on the budget line. However, either the Amortization Schedule and/or the Offset Account can be overridden via a Line Action on the budget worksheet.

SPWs and Cash Flow

For budget lines controlled by an SPW, the SPW determines the balance sheet impact of each item that is part of the budget line. (This applies to WSPWs and GSPWs.) The balance sheet impact is usually determined by the default Amortization Schedule and Offset Account for the GL account used on the SPW line. However, either the Amortization Schedule and/or the Offset Account can be overridden via the Cash Flow tab on the SPW line.

GSPWs can be used to budget for income and expense items that have a simple Balance Sheet Impact. However, they are also used to budget for items with a more complex balance sheet and cash flow impact, including prepaid expenses, deferred revenue, loan principal payments, etc. A “Cash Flow Template” is selected to identify these complex items, and this determines the information required on the SPW line.

Understanding Cash Flow Templates

SPWs (both WSPWs and Global SPWs) can be used to budget for income and expense items that have a simple Balance Sheet Impact. Global SPWs are also used for items with a more complex balance sheet and cash flow impact, including loan principal payments, prepaid expenses, and deferred revenue. For these complex items, it is important to select the correct cash flow template. That cash flow template determines the information that you must enter and the balance sheet impact of the GSPW line.

The Cash Flow Templates and their Balance Sheet Impacts are listed here. They are described and illustrated in detail in the Cash Flow Forecasting - Examples Knowledge Base Article.

| Template | Budgeted? | Balance Sheet Impact |

| Loan Principal Payments | No | One non-amortized line and one amortized line |

| Prepaid Expense Billing & Recognition | Yes | Two amortized lines |

| Prepaid Expense | No | One non-amortized line and one amortized line |

| Deferred Revenue & Recognition | Yes | Two amortized lines |

| Deferred Revenue | No | One non-amortized line and one amortized line |

| Fixed Asset | No | One non-amortized line and one amortized line |

| Fixed Asset (checkbox for Sale) | No | Two non-amortized line and one amortized line |

| Opening a Loan | No | One non-amortized line |

| VAT and Sales Tax | Yes | Two amortized lines |

| Balance Sheet Transfers | No | Two non-amortized lines |

Special Use Cases

Use this guide to configure activity that has specific balance sheet impacts.

Budgeted Expenses that Hit a Cash Account Directly

Some budgeted expenses may be paid directly out of a cash account rather than applied to Accounts Payable. For example, salary costs are often applied directly to a payroll account. To reflect this properly, assign the payroll account as the default Offset Account for the GL accounts to which the compensation expenses are budgeted.

Release of Funds from Restriction

This can be budgeted using an income account on a worksheet, WSPW, or Global SPW. If using an SPW line, the template should be the default Standard Income/Expense with the equity account selected as the balance sheet account. The result will be an increase in income and a decrease in the equity account. Use the 00 No Amortization mapping since the effects on the income and balance sheet accounts happen at the same time.

Depreciation

This can be budgeted using an expense account on a worksheet, WSPW, or Global SPW. If using an SPW line, the template should be the default Standard Income/Expense with the accumulated depreciation account selected as the balance sheet account. The result will be an increase in expenses and a decrease to the accumulated depreciation account, resulting in a negative balance for accumulated depreciation on the Projected Balance Sheet. Use the 00 No Amortization mapping since the effects on the expense and balance sheet accounts happen at the same time.

Prepaid Expense and Recognition

There are two methods for handling prepaid expenses.

| One-Step Streamlined Method Equal Prepayment Amounts | Two-Step Detailed Method Varied Prepayment Amounts |

| Use the Prepaid Expense and Recognition template on the SPW to handle the prepayment and budgeted expense in one step. | Pair a Prepaid Expense template SPW line with a separate line that recognizes the expense, either on a budget worksheet or on an SPW using the Standard Income/Expense template. |

| This streamlined method allows you to assign a straight prepayment value monthly, quarterly, or annually. | This method allows you to specify monthly amounts if your payments are not made in equal installments. |

| Use for prepayments made in equal installments monthly, quarterly, or annually, for example, liability insurance premiums. | Use for payments not made in equal monthly, quarterly, or annual installments, for example, a legal retainer paid in January and then additional payments made late in the year once the initial retainer has been spent. |

Deferred Revenue and Recognition

There are two methods for handling deferred revenue.

One-Step Streamlined Method Equal Deferred Revenue Amounts | Two-Step Detailed Method Varied Deferred Revenue Amounts |

| Use the Deferred Revenue and Recognition template on the SPW to handle the deferred revenue and budgeted income in one step. | Pair a Deferred Revenue template SPW line with a separate line that recognizes the income, either on a budget worksheet or on an SPW using the Standard Income/Expense template. |

| This streamlined method allows you to assign a straight deferred revenue value monthly, quarterly, or annually. | This method allows you to specify monthly amounts if your revenue is not billed evenly across the year. |

Use for deferred revenue billed in equal installments monthly, quarterly, or annually, for example:

| Use for deferred revenue not billed in equal monthly, quarterly, or annual installments, for example:

|

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article