Pay types represent each form of compensation that you want to budget on a per-position basis. Pay types are then applied to positions as appropriate. For example, some positions may include salary, medical insurance, 401k matching and FICA pay types, while others may only include hourly and FICA pay types.

Pay Types & Pay Items

Pay Types are defined at the organizational level and are applied individually at the position level. When applied to a position, a Pay Item is created to control the details of that Pay Type/Position relationship. For example, while many positions may use a salary pay type, each pay item will hold the salary amount for that specific position.

Common Pay Types

Some common forms of compensation include:

- Hourly pay

- Salary pay

- Overtime pay

- Year-end bonus

- Anniversary bonus

- Health insurance

- Cellphone reimbursement

- Employer’s retirement contribution

- FICA

- Worker's comp

- Life insurance

- STD & LTD

- Housing allowance

The Pay Types Page

Navigate to Personnel Budgeting > Pay Types. The Pay Types list provides an overview of all pay types as well as key details.

Pay Types Page Actions

- Add New Pay Type - Click to add a new pay type.

- Export (xlsx) - Export the list of pay types.

- Drag and Drop - Use the grab icon to re-order pay types. This is helpful when viewing the Pay Items tab in Scenarios.

- Edit (pencil icon) - Click the pencil icon to edit an existing pay type.

The Pay Type Record

Each pay type is defined by the following fields, some of which present based on other options selected.

- Name - The unique name for this pay type.

- Account - The account associated with this pay type. Statistical accounts can be assigned to pay types in order to calculate statistical costs. Examples include square footage occupied, number of FTEs represented, etc. Pay types using statistical accounts must be Non-Taxable.

- Tax - The taxable status of this pay type.

- Taxable - Pay types subject to regular employer payroll taxes. This applies only to taxes calculated on the basis of the Config setting (in other words, if the FICA rate is defined on the Config screen).

- Non-Taxable - Pay types that are never subject to employer payroll taxes, including certain health benefits, retirement contribution matching, housing allowances, and salaries for clergy. This applies only to taxes calculated on the basis of the Config setting (in other words, if the FICA rate is defined on the Config screen).

- Is Tax - Used to budget for payroll taxes. The pay types subject to this tax must be specified as "Source Pay Types" below. Amounts calculated by these pay types can be included and excluded from the scenario's Summary screen with the Show Taxes checkbox.

- Taxable - Pay types subject to regular employer payroll taxes. This applies only to taxes calculated on the basis of the Config setting (in other words, if the FICA rate is defined on the Config screen).

- Category - The way the pay type will be calculated.

- Regular - Martus will multiply the Regular Amount (a default in the pay type or the amount specified in the pay item) by the Frequency.

- Hourly - Martus will multiply the Hourly Amount (a default in the pay type or the amount specified in the pay item) by the Hours Per Pay Period (specified in the pay item) by the Frequency.

- Percentage - Martus will use the percentages specified and the Source Pay Types. Percentage requires additional information.

- Overtime - Martus will multiple the hourly rate on the position, by the percentage indicated, by the hours per pay period on the position. NOTE: This should only be used with Hourly pay types. NOTE: Mid-year adjustments made to Hourly pay types will not apply to Overtime pay types. Overtime pay types will always use the Hourly base rate.

- Frequency - How often the pay type will be calculated.

- Monthly - The amount entered is a full monthly amount, whether using the default Regular Amount on the pay type or the specific amount on the pay item.

- Semi-Monthly - The amount entered is a half the monthly amount, whether using the default Regular Amount on the pay type or the specific amount on the pay item.

- Bi-Weekly - The amount entered is a bi-weekly amount, whether using the default Regular Amount on the pay type or the specific amount on the pay item. Martus will use the bi-weekly start date on the scenario's Config tab to determine which months will have two periods and which will have three.

- Weekly - The amount entered is a weekly amount, whether using the default Regular Amount on the pay type or the specific amount on the pay item. Martus will use the weekly start date on the scenario's Config tab to determine which months will have four periods and which will have five.

- Once - Use the Start Date to apply the amount in one month per year.

- Anniversary - Use the employee's Anniversary Date to apply the amount on the employee's anniversary; often used for longevity bonuses.

Using the Bi-Weekly or Weekly frequency will result in the budget showing increases in the months with additional pay periods. If the desired budget is flat across all months, use the Monthly or Semi-Monthly frequency and adjust the amount and/or hours appropriately.

- Start Date - Controls the start date for this pay type. Most often used with the Once frequency to determine which month to budget. Use Start Date for pay types that are going to begin mid-year. For all ongoing pay types, leave this blank.

- Limit - The annual limit for this pay type. For example, if the organization will match a retirement contribution up to $6000 per year, enter 6000. Martus will stop budgeting for this pay item once the limit is reached.

- Calendar Limit - Used with the Limit field. If the fiscal year does not start in January, Martus will apply the budgeted amounts starting in January rather than the fiscal year start.

- Employer Percent - The percentage of the Source Percent that the employer is paying. Normally this is set to 100%, but could be less when the employer is not fully responsible for the entire tax or benefit amount.

- Source Percent - The percentage of the total of the applicable Source Pay Types that will be budgeted.

- Notes - Enter applicable notes regarding the pay type. Notes will appear below the Starting Rate/Amount when assigning pay items to a position, in Edit Position > Edit Pay Items.

- Regular Amount or Hourly Amount - Used as a default when applied to a Position as a Pay Item. The default can be overridden on the individual pay items as needed. Normally this is used for things such as a cell phone allowance which will be the same for the majority of employees. Leave blank for individualized pay types such as salary or hourly.

- Add New Tiers - Tiers allow for more complex calculations. When Add New Tiers is clicked, the following drop down will appear, and additional details are required, shown below.

- Months Employed - Allows for default values based on longevity. Uses the employee Anniversary Date to calculate the amount. For example, a longevity bonus may be calculated at the 5, 10, 15, and 20 year mark by using the minimum and maximum months employed and adding lines for 60, 120, 180 and 240 months.

- Name - The name of the tier.

- Minimum Months Employed - The smallest value used before this pay type should be calculated.

- Maximum Months Employed - The largest value used before this pay type should stop being calculated.

- Regular Amount - The amount to be budgeted.

- Add (+) button - Used to add a new tier.

- Fiscal Year- Used when an increase should apply to only one fiscal year that can be tracked from year to year. Use with the Monthly frequency.

- Name - The name of the tier.

- Starting Year - The smallest value used before this pay type should be calculated.

- Ending Year - The largest value used before this pay type should stop being calculated.

- Regular Amount - The amount to be budgeted.

- Add (+) button - Used to add a new tier.

- Fiscal Month - Used when wanting to budget only within certain months, such as quarterly. Use with the Monthly frequency.

- Name - The name of the tier.

- Month - The month the amount should be budgeted in

- Regular Amount - The amount to be budgeted.

- Add (+) button - Used to add a new tier.

- Coverages - Coverage 1 and Coverage 2 both use the corresponding coverage indicated on the Employee record. Coverage 1 is normally used for medical insurance. Coverage 2 is normally used for Dental AND Vision insurance. Click here for more information on Coverages.

- Name - The name of the tier.

- Coverage - The level of coverage for which to budget.

- Regular Amount - The amount to be budgeted.

- Add (+) button - Used to add a new tier.

- Source Pay Types - A list of all pay types that will be summed per month from which the Source Percent is calculated.

- New Source Pay Type - Add additional Source Pay Types.

Adding a New Pay Type

- Navigate to Personnel Budgeting > Pay Types.

- Click Add New Pay Type.

- Fill out the fields appropriately. See below for more details.

- Click Save or click Cancel to cancel.

Editing an Existing Pay Type

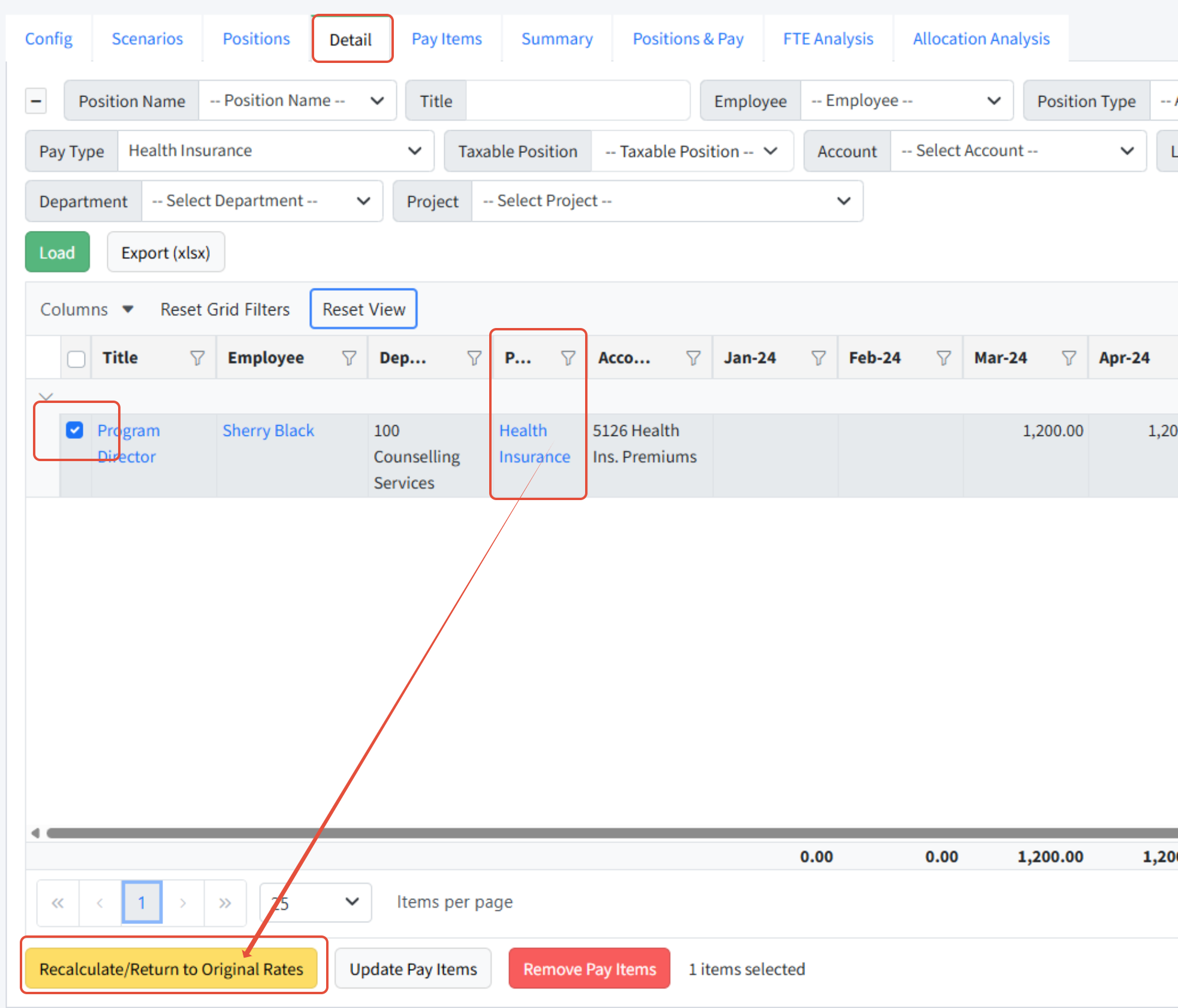

After you edit an existing pay type, those changes are not immediately applied to any scenario. You must go to the Detail tab for that scenario, select the pay item rows for that pay type, and then click Recalculate/Return to Original Rates.

In the Details tab, update the lines for the pay type you just updated. Select the pay type using the dropdown or grid filters, select the lines, and then click Recalculate/Return to Original Rates. This will apply the pay type change to the selected lines.

Copying an Existing Pay Type

Copying a Pay Type can be very helpful when there are multiple, similar pay types, such as Payroll tax (Medicare & Social Security) that both depend on the same Pay Types. A copied Pay Type can then be applied to a Scenario using the Pay Types page.

- Click Edit to open a similar Pay Type record

- Scroll down to the bottom.

- Click Duplicate.

- The copy will open in Edit mode and have the word "COPY" in the Name.

- Adjust the name and any other details as appropriate.

- Click Save.

Deleting Pay Types

- If a new Pay Type has been added by mistake, it can be Deleted:

- From Personnel Budgeting > Pay Types

- Click Edit next to the appropriate Pay Type

- Click Delete to remove it.

- If a Pay Type has been utilized in a Scenario it is not recommended to delete it. Instead rename the Pay type to indicate it is no longer in use and drag it to the bottom of the sort order on the Pay Types page.

Notes about Pay Types

- Each pay type must be unique; two pay types cannot have the same name.

- Pay types are global; they apply to all years and all scenarios.

- Any change to a pay type will not change any scenario until a user goes to the scenario and selects the corresponding pay items and clicks Recalculate/Return to Original Rates.

- The best way to assign a Pay Type to every Position is to use the Pay Item Grid Export/Import process.

Pay Type Examples

Some common and not-so-common pay type examples can be found here.

Use the links below to navigate through the learning path.

Config Tab << Building a Scenario - Learning Path >> Employees

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article